wake county nc sales tax breakdown

Wake county nc sales tax. Learn about listing and appraisal methods appeals and tax.

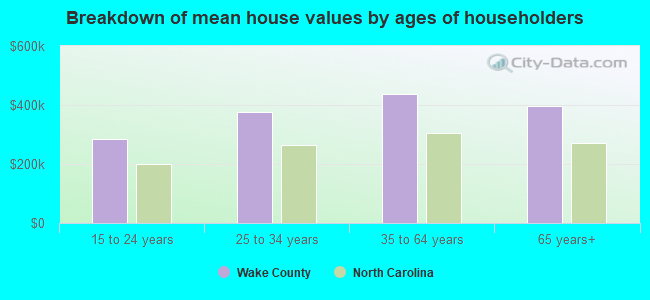

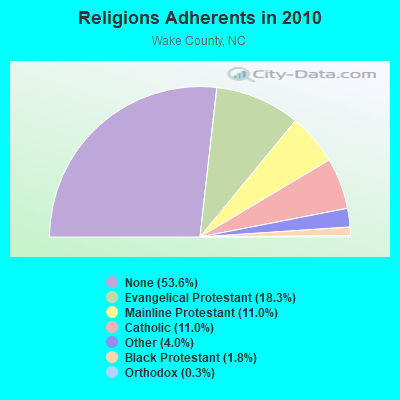

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

This rate includes any state county city and local sales taxes.

. This is the total of state and county sales tax rates. This rate includes any state county city and local sales taxes. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The most populous zip code in Wake County North Carolina is 27610. 2020 rates included for use while preparing your income tax deduction. Within one year of surrendering the license plates the owner must present.

2020 rates included for use while preparing your income tax deduction. The average cumulative sales tax rate in the state of North Carolina is 694. This rate includes any state county city and local sales taxes.

2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Wake County North Carolina is. The latest sales tax rate for Raleigh NC.

2020 rates included for use while preparing your income tax. This takes into account the rates on the state level county level city level and special level. 2020 rates included for use while preparing your income tax deduction.

Prepared Food and Beverages This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that. The one with the highest sales tax rate is 27502 and the one with the lowest sales tax rate is 27523. The latest sales tax rate for Zebulon NC.

Search real estate and property tax bills. 3 rows Sales Tax Breakdown. Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund.

The minimum combined 2022 sales tax rate for wake forest north carolina is. 7 sales and use tax chart. The North Carolina state sales tax rate is currently.

Pay tax bills online file business listings and gross receipts sales. Wake County Public Libraries 919-250-1200. This includes the rates on the state county city and special levels.

North Carolina has a 475 sales tax and Wake County collects an. The average cumulative sales tax rate in Wake Forest North Carolina is 725. The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills.

The latest sales tax rate for Garner NC. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. Wake County Nc Sales Tax Breakdown. This is the total of state and county sales tax rates.

The latest sales tax rate for Wake County NC. Historical County Sales and Use Tax Rates. PO Box 25000 Raleigh NC 27640-0640.

35 rows Wake. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. This rate includes any state county city and local sales taxes.

The latest sales tax rate for Wake Forest NC. This rate includes any state county city and local sales taxes.

Sales Taxes In The United States Wikipedia

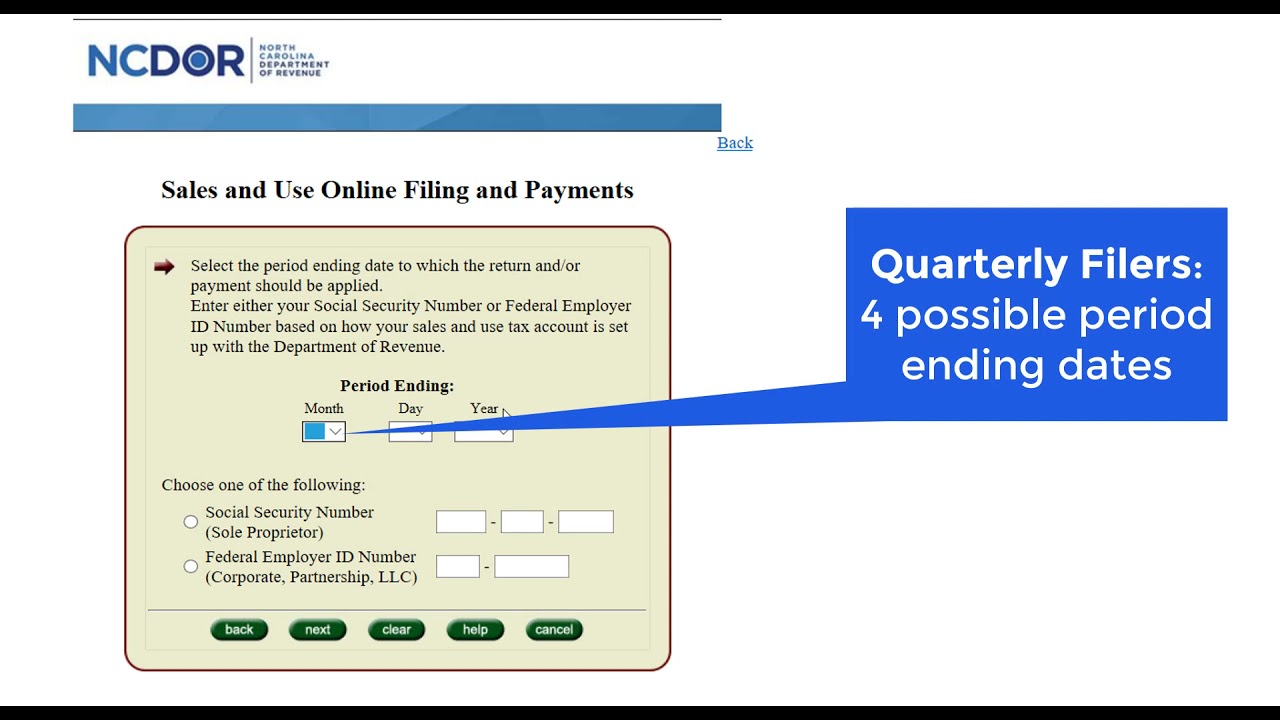

Online File Pay Sales And Use Tax Due In One County In Nc Youtube

Wake Forest Business Industry Partnership

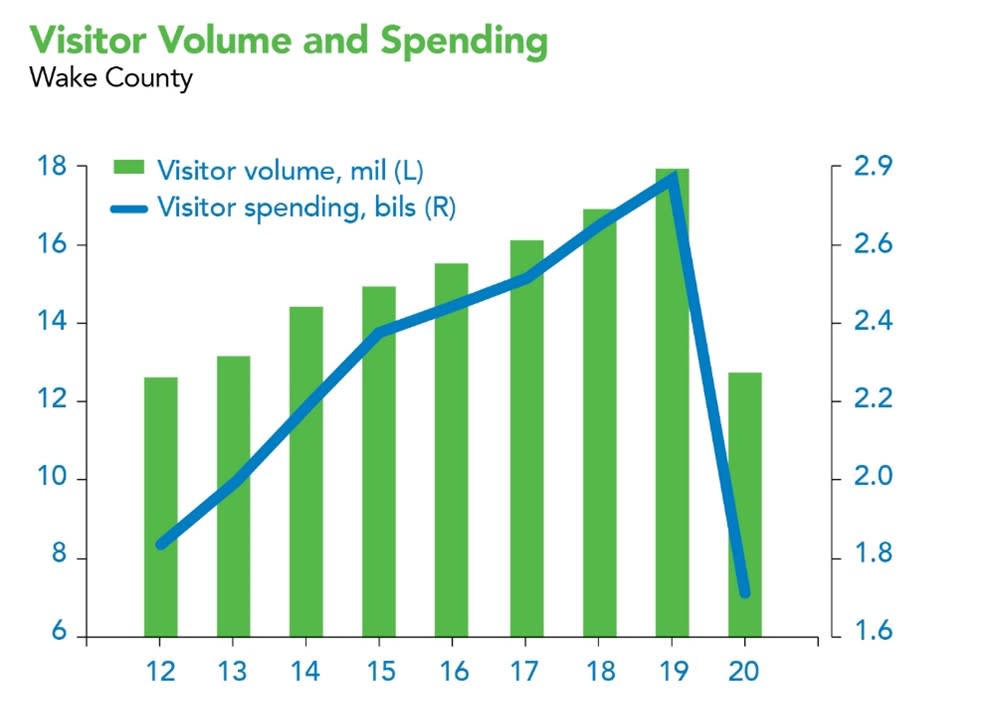

2020 Wake County Visitation Figures Released

North Carolina Sales Tax Rates By County

December 2021 S Median Sales Price For Wake County Real Estate Was 411 000 Highest In 2021 And Of All Time Wake County Government

Local Option Sales Tax Wayne County Nc

Local Option Sales Tax Wayne County Nc

North Carolina Sales Tax Small Business Guide Truic

Median Sales Price Of Wake County Real Estate Hits Another New All Time High Of 405 000 In November 2021 Wake County Government

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake Forest Business Industry Partnership

Experience Downtown Wake Forest Town Of Wake Forest Nc

2020 Property Reval For Wake County And Cabarrus County Clt Public Relations

Amazon Com Wake County North Carolina Zip Codes 48 X 36 Paper Wall Map Office Products

North Carolina Sales Tax Calculator Reverse Sales Dremployee

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price