child tax credit november 2021 payments

The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

Child Tax Credit Schedule 8812 H R Block

Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

. The Child Tax Credit provides money to support American families helping them make ends meet more easily. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child.

The American Rescue Plan has expanded the CTC for the 2021 tax year. Children who are adopted can also qualify if theyre US citizens. Before this year the refundable portion of the CTC was limited to 1400 per child.

Those payments will last through December. These changes will only apply for the 2021 tax year. The couple would then receive the 3300.

The American Rescue Plan signed into law by President Biden on March 11 2021 increases the Child Tax Credit CTC to provide up to 300 per month per child under age 6 and up to 250 per month per child ages 6 to 17. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. Generally you need to unenroll by at least three days before the first Thursday of the month in which the next payment is scheduled to arrive you have until 1159 pm.

Thats an increase from the regular child tax credit of up. The enhanced child tax. 13 opt out by Aug.

2021 Child Tax Credit and Advance Payments. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The enhanced child tax.

Will they send any more in 2022. The enhanced child tax. The Child Tax Credit helps all families succeed.

2021 installment is expected to hit bank accounts next week. Most families are automatically. Tarting last Monday November 15 a new advance Child Tax Credit CTC payment is being disbursed by the IRS this is the fifth of six monthly payments that are sent out.

2021 The fifth monthly payment of the enhanced child tax credit is expected to hit your bank. The CTC in 2021 is a fully refundable tax credit meaning that eligible families can receive it even if they owe no federal income tax. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021.

Benefit and credit payment dates. The IRS sent six monthly child tax credit payments in 2021. 29 What happens with the child tax credit payments after.

3 January - England and Northern. E-File Directly to the IRS. Low-income families who are not getting payments and have not filed a tax return can still get one.

Families must claim Child Tax Credit by November 15 to receive payments this year. The IRS sent six monthly child tax credit payments in 2021. The IRS is paying 3600 total per child to parents of children up to five years of age.

Home of the Free Federal Tax Return. Children who are. When Will Your November Payment Come.

Families could receive child tax credit rebates for up to 250 per child under age 18 maxing out at three kids. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Final Child Tax Credit Payment Opt-Out Deadline is November 29 The due date for opting out of the December 15 monthly child credit payments is almost here.

Eligibility caps at 100000 income for a. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

The Child Tax Credit was to be expanded for five years until 2025 but now the end of 2022 will be the deadline. By August 2 for the August. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Child tax credit payment for Nov. See what makes us different. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

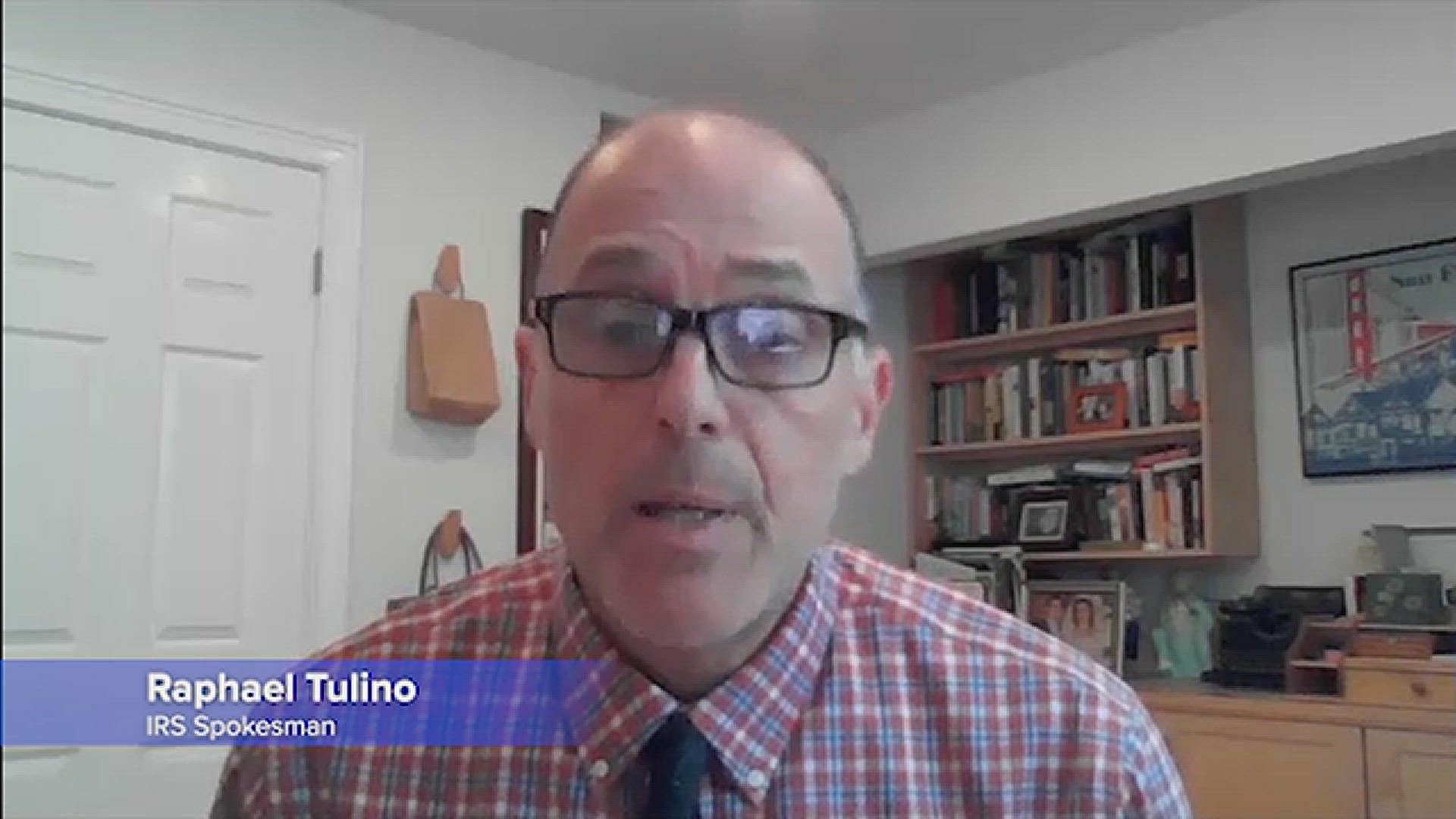

IR-2021-222 November 12 2021. We dont make judgments or prescribe specific policies. The maximum monthly payment for a family that received its first payment in November was 900-per.

That drops to 3000 for each child ages six through 17. Another key deadline is coming up next week for parents eligible for the November child tax credit payment the second-to-last one of the year. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

If you have a baby anytime in 2021 your newborn will count toward the child tax credit payment of 3600.

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit 2021 8 Things You Need To Know District Capital

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Aish Benefit And Payment Dates 2022 Wallet Bliss

Child Tax Credit 2021 8 Things You Need To Know District Capital

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

New Stimulus Payments Arrived Friday Here S How Many More Payments Are Coming Wbff

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Child Tax Credit 2021 How To Apply Before Nov 15 Deadline

Child Tax Credit 2021 How To Apply Before Nov 15 Deadline

Child Tax Credit 2021 How To Apply Before Nov 15 Deadline

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Is Your Family Eligible For The Child Tax Credit Payments Legal Aid Of Nebraska